Navigating the ever-evolving landscape of financial markets can be a daunting task, particularly for investors seeking to maximize their returns while mitigating risks. Value investing, a strategy that aims to capitalize on undervalued assets, has been gaining traction in recent times. However, amidst the allure of potential gains, there are several downside risks that investors should be mindful of when considering value stocks.

1. Value Traps: One of the primary risks associated with value investing is the possibility of falling into a value trap. These traps occur when a stock appears inexpensive based on traditional valuation metrics like price-to-earnings ratios, but the underlying business fundamentals are deteriorating. Investors may be lured by seemingly cheap prices only to realize that the stock’s value continues to decline.

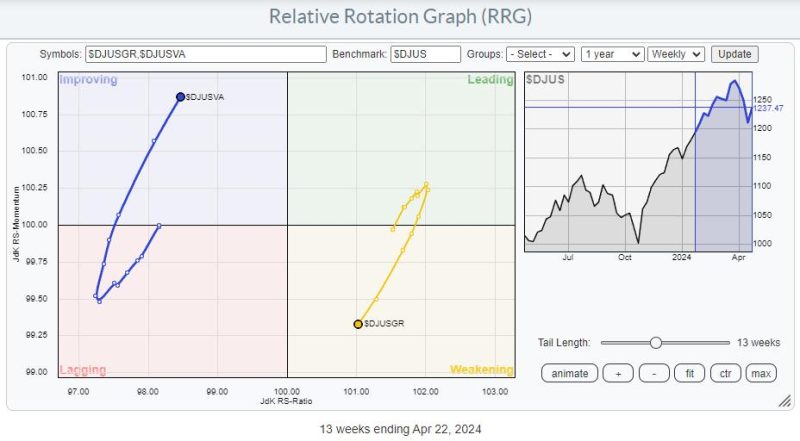

2. Cyclical Nature of Value Stocks: Value stocks are often found in sectors that are cyclical in nature, such as energy, financials, and materials. These sectors are highly sensitive to changes in economic conditions, including interest rates, commodity prices, and consumer demand. As a result, value stocks can experience significant volatility, making them susceptible to sudden downturns during economic downturns.

3. Limited Growth Potential: Value stocks are typically companies that are trading at a discount relative to their intrinsic value. While these stocks may offer stability and income generation, they often lack the growth prospects of their high-flying counterparts in the growth stock category. Investors must carefully weigh the trade-off between value and growth when constructing their portfolios to ensure a balance of risk and return.

4. Market Timing Challenges: Identifying the right time to buy or sell value stocks can be challenging. Value investing is a long-term strategy that requires patience and discipline, as it may take time for the market to recognize the underlying value of a stock. Moreover, value stocks may underperform growth stocks in the short term, leading some investors to second-guess their investment decisions.

5. Sector Concentration Risks: Value investors often concentrate their holdings in specific sectors or industries that are trading at a discount. While this strategy can offer diversification benefits, it also exposes investors to sector-specific risks. A downturn in a particular industry can have a significant impact on the performance of value stocks within that sector, potentially leading to losses for the investor.

6. Behavioral Biases: Investors are not immune to behavioral biases, such as anchoring or overconfidence, which can cloud their judgment when evaluating value stocks. Emotions play a significant role in investment decisions, and investors may be tempted to hold onto underperforming value stocks in the hope of a rebound, leading to missed opportunities or further losses.

7. Corporate Governance Issues: Value stocks are sometimes associated with companies that have poor corporate governance practices, such as weak board oversight or conflicts of interest among executives. Investing in companies with questionable governance standards can expose investors to legal, financial, and reputational risks, as well as potential value destruction.

8. Liquidity Concerns: Value stocks, especially those in small-cap or illiquid markets, may lack the liquidity needed to easily buy or sell shares without significantly impacting the stock price. Limited liquidity can also make it challenging for investors to exit their positions quickly in times of market stress, leading to potential losses or missed opportunities.

9. External Factors: Value stocks are not immune to external factors that can impact their performance, such as geopolitical events, regulatory changes, or macroeconomic trends. Investors must stay abreast of these factors and their potential implications for value stocks in order to make informed investment decisions and manage risks effectively.

10. Competitive Pressures: In today’s hypercompetitive global markets, companies face intense competition from both traditional rivals and disruptive newcomers. Value stocks may struggle to maintain their competitive edge in rapidly changing industries, leading to diminished returns and potential value erosion over time.

In conclusion, while value investing can be a rewarding strategy for long-term investors seeking opportunities in undervalued assets, it is crucial to be aware of the potential downside risks associated with this approach. By carefully evaluating these risks and implementing sound risk management practices, investors can position themselves to navigate the complexities of value investing successfully and achieve their long-term financial goals.