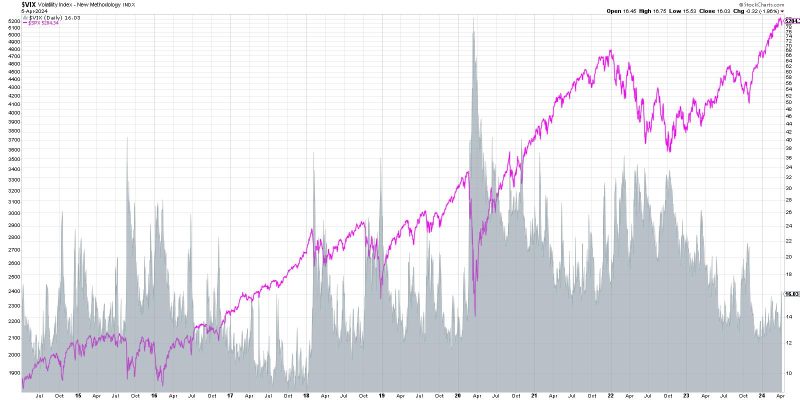

In a recent article from GodzillaNewz.com, the VIX (Volatility Index) has surged above 16, prompting concerns among investors and market analysts. The VIX is often referred to as the fear index as it measures the market’s expectation of volatility over the next 30 days.

The spike in the VIX above 16 is significant because it indicates a rise in investor uncertainty and fear regarding potential market turbulence. This increase could be attributed to various factors such as geopolitical tensions, economic data releases, or corporate earnings reports that are concerning market participants.

Investors closely monitor the VIX as it provides them with valuable insights into market sentiment and risk appetite. A high VIX level suggests heightened market uncertainty and potential downside risks, while a low VIX level indicates investor complacency and a relatively stable market environment.

The recent spike in the VIX above 16 has raised questions about whether this could be the precursor to a larger market correction. Historically, sharp increases in the VIX have often been associated with market sell-offs as investors rush to hedge against potential losses.

While a high VIX level can signal increased market turbulence, it is essential for investors to interpret this indicator in the context of broader market trends and economic fundamentals. Market volatility is a natural part of the investing landscape, and occasional spikes in the VIX should not necessarily be a cause for panic.

Investors should remain vigilant and stay informed about market developments while maintaining a diversified portfolio to weather potential market downturns. It is crucial to keep a long-term perspective and not make hasty decisions based on short-term fluctuations in the VIX.

In conclusion, the recent spike in the VIX above 16 has caught the attention of investors and market participants, signaling a potential increase in market volatility and uncertainty. While this development may raise concerns about a possible market correction, it is essential for investors to stay informed, maintain a diversified portfolio, and approach investing with a long-term perspective. Ultimately, understanding the nuances of market indicators like the VIX can help investors navigate changing market conditions and make informed investment decisions.