In the ever-volatile world of stock markets, one of the most pivotal indices for investors to keep an eye on is the Nifty. Nifty, short for Nifty Fifty, is the National Stock Exchange’s benchmark stock market index for the Indian equity market. It comprises of 50 actively traded stocks, representing various sectors of the Indian economy.

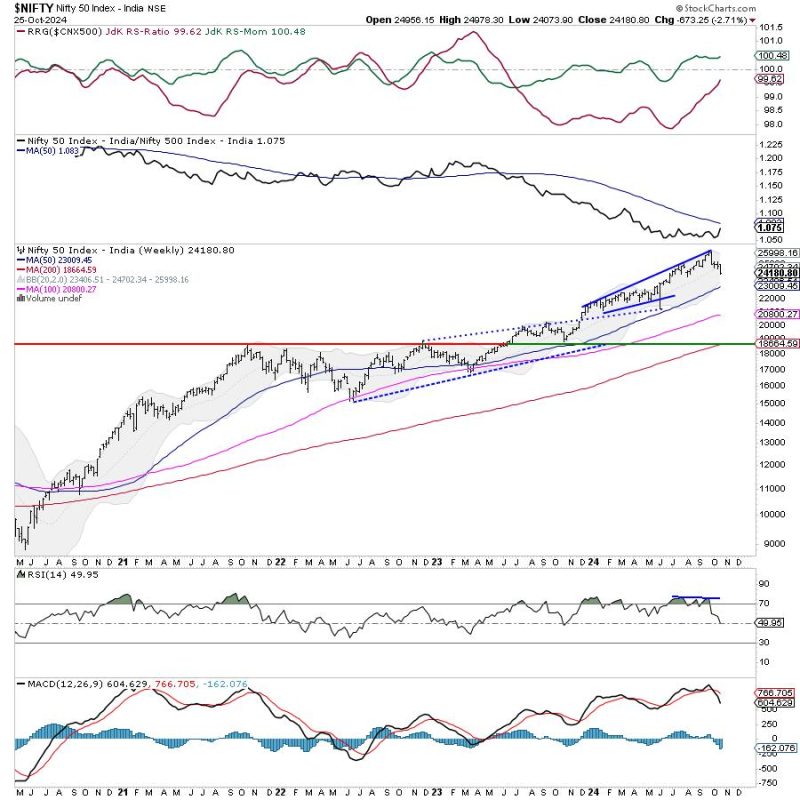

Identifying key support and resistance levels in the Nifty index is crucial for traders and investors to make informed decisions. The recent price action in Nifty has raised concerns as the index violated key support levels, subsequently dragging the resistance lower.

Support and resistance levels play a significant role in technical analysis, providing traders with potential entry and exit points. When a support level is breached, it often indicates increased selling pressure in the market. This breach can signal a potential downtrend or correction in the index. Conversely, when a resistance level is lowered, it implies a weakening bullish sentiment and may hinder upward price movement.

The violation of key support levels in the Nifty index can have several implications for traders and investors. Firstly, it may indicate a shift in market sentiment towards a more bearish outlook. Traders who were holding long positions in anticipation of a bullish trend may now consider exiting their positions to mitigate potential losses.

Moreover, the violation of support levels can lead to increased volatility in the market, as traders adjust their strategies based on the new price dynamics. This heightened volatility may present both opportunities and risks for active traders looking to capitalize on short-term price movements.

Additionally, the drag on resistance levels further complicates the market outlook. A lowered resistance level implies that it may be more challenging for the index to recover and resume its uptrend. This can deter new buyers from entering the market and may prolong the consolidation or downtrend in the Nifty index.

In conclusion, the recent violation of key support levels in the Nifty index has introduced uncertainty and increased volatility in the market. Traders and investors need to closely monitor the evolving price action and adjust their strategies accordingly to navigate these challenging times effectively. Adapting to the new market dynamics and being vigilant in identifying potential opportunities will be crucial in maximizing returns and managing risks in the current scenario.