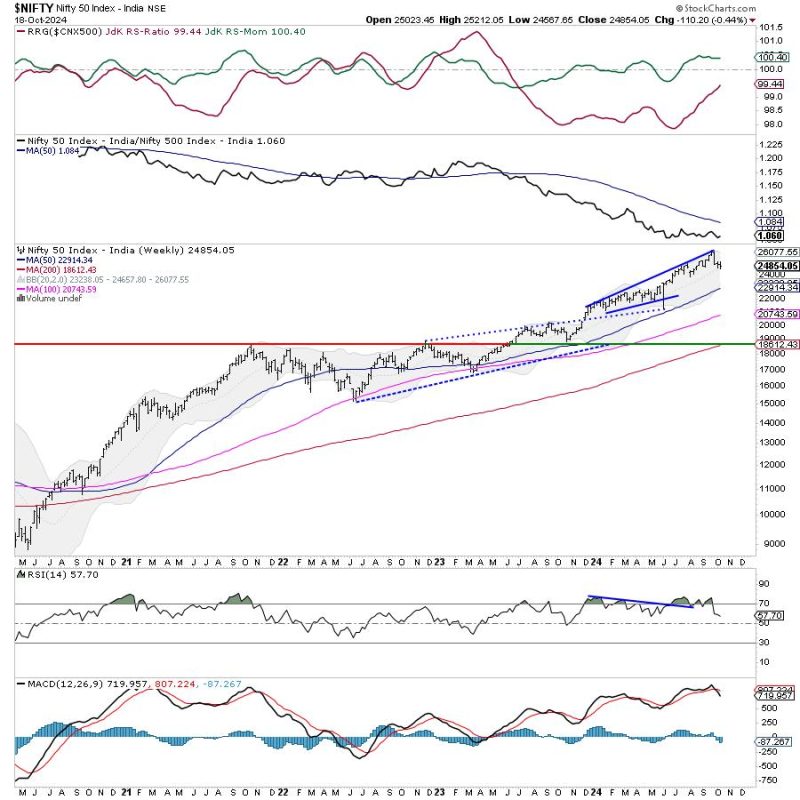

The week ahead in the Nifty may present a scenario where the index remains within a range, with potential trending movements only likely to occur if specific key levels are breached. Investors and traders keen on navigating the market must pay close attention to these critical points to gauge the direction of the index accurately.

First and foremost, technical analysts are keeping a keen eye on the Nifty’s performance relative to the crucial support and resistance levels. By closely monitoring these levels, market participants can gain valuable insights into potential market movements and make informed decisions about their trading strategies.

Additionally, the article emphasizes the significance of the 50-DMA (Daily Moving Average) as a pivotal indicator that can influence market sentiment and trends. Traders observing how the Nifty interacts with this moving average can gain valuable insights into the index’s overall momentum and potential future price actions.

Another critical aspect highlighted in the article is the importance of monitoring the index’s behavior near the 15,850 and 15,600 levels. These zones are considered key support and resistance levels, and breaching these thresholds could potentially trigger significant market movements and establish new trend directions in the Nifty.

Moreover, investors are advised to remain cautious and flexible in their trading approach, as market conditions can quickly change based on various external factors such as economic data releases, global market trends, and geopolitical developments. By staying attuned to these factors, traders can adapt their strategies effectively and capitalize on emerging opportunities in the market.

In conclusion, the upcoming week in the Nifty is poised to offer a mix of range-bound trading and potential trending movements based on critical support and resistance levels. By paying close attention to these key indicators and remaining adaptable in their trading strategies, investors can navigate the market confidently and make well-informed decisions to optimize their trading outcomes.