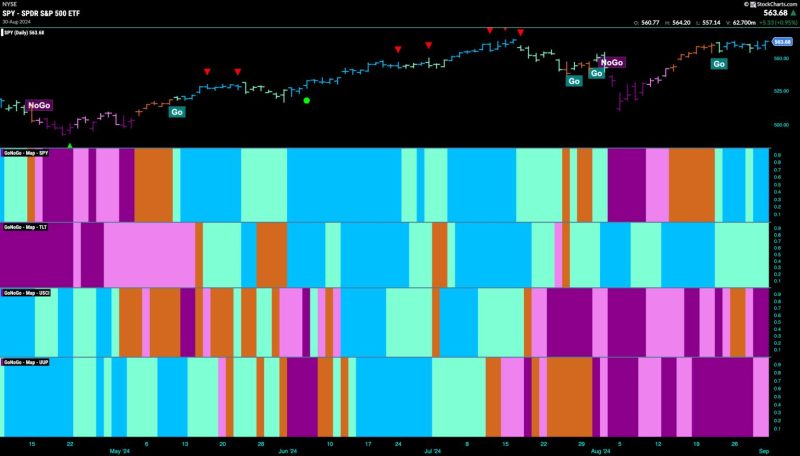

Equities Hold Firm in ‘Go’ Trend as Industrials Play Strong Defense

In the world of investing, the performance of equities is often a key indicator of market sentiment and economic outlook. Recently, equities have been holding firm in what some analysts are calling the ‘Go’ trend, characterized by persistent bullish momentum and positive investor confidence. Amidst this trend, the industrials sector has emerged as a key player, displaying notable strength in its defensive capabilities.

One of the main drivers behind the solid performance of equities in the ‘Go’ trend has been the overall resilience of the market in the face of various economic challenges and uncertainties. Despite ongoing trade tensions, geopolitical risks, and concerns about slowing global growth, equities have managed to weather the storm and continue their upward trajectory. This has helped instill confidence among investors and provided support for the broader market.

Within the industrials sector, companies have played a particularly strong role in supporting the overall performance of equities. Industrials are often seen as a bellwether for the economy, given their exposure to various sectors and their reliance on global demand. In the current environment, industrials have demonstrated their ability to withstand market volatility and provide stability to investors’ portfolios.

One of the key reasons for the industrials sector’s robust performance has been its defensive characteristics. Industrial companies tend to have a diverse customer base and a wide range of products and services, which can help mitigate risks associated with specific market fluctuations or economic downturns. This diversification has allowed industrials to navigate choppy waters and remain resilient in the face of uncertainty.

Moreover, industrials have also benefited from strong fundamentals and favorable industry trends. Many industrial companies have posted solid earnings and revenue growth, supported by healthy demand for their products and services. In addition, advancements in technology and automation have helped increase efficiency and productivity, driving profitability and enhancing competitiveness in the global market.

Looking ahead, the outlook for equities and the industrials sector remains positive, albeit with some uncertainties on the horizon. Investors will be closely monitoring key macroeconomic indicators, such as trade developments, central bank policies, and corporate earnings reports, to gauge the health of the market and make informed investment decisions. With a focus on resilience, diversification, and adaptability, both equities and the industrials sector are poised to continue their strong performance in the ‘Go’ trend.

In conclusion, the current market environment has been characterized by a persistent ‘Go’ trend in equities, supported by the industrials sector’s strong defense and resilience. Despite economic challenges and uncertainties, equities have held firm, buoyed by positive investor sentiment and the solid performance of industrial companies. By focusing on fundamentals, diversification, and innovation, both equities and industrials are well-positioned to navigate the complexities of the market and capitalize on future opportunities.