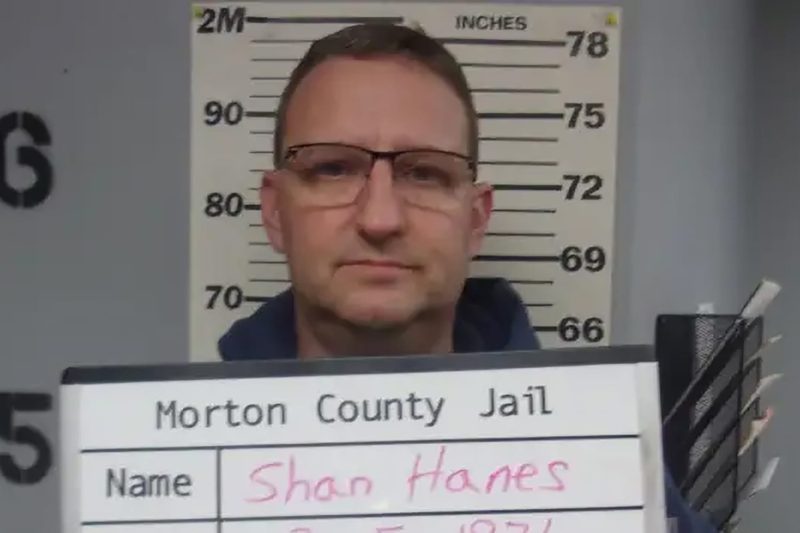

Cryptocurrency Pig-Butchering Scam Wrecks Kansas Bank, Sends ex-CEO to Prison for 24 Years

The recent scandal involving a cryptocurrency pig-butchering scam has rocked the banking world in Kansas, resulting in the downfall of a once prominent financial institution and the imprisonment of its former CEO for a staggering 24 years. This shocking turn of events sheds light on the dangers and complexities of the growing cryptocurrency market and serves as a cautionary tale for both investors and financial institutions.

The scheme, orchestrated by former bank CEO John Peterson, involved the creation of a fictional cryptocurrency called PiggyCoin that purported to be backed by physical pig butchering operations. Investors were promised significant returns on their investments, lured in by the appeal of a unique and seemingly lucrative opportunity. However, it soon became evident that the entire operation was nothing but a clever facade.

As investigations unfolded, it was revealed that no pig butchering operations existed, and the funds invested by unsuspecting individuals were instead used to finance Peterson’s lavish lifestyle and cover up his fraudulent activities. The once-thriving Kansas bank, which had been in operation for over a century, quickly crumbled under the weight of the scandal, leaving employees jobless and customers in a state of disbelief.

The fallout from the cryptocurrency pig-butchering scam has had far-reaching consequences, not only for the bank and its stakeholders but also for the wider financial industry. Regulators and lawmakers are now grappling with how to best protect consumers and investors from similar schemes in the future, as the rapidly evolving world of cryptocurrency presents new challenges and opportunities.

One of the key lessons to be drawn from this unfortunate episode is the importance of due diligence and skepticism when it comes to investing in cryptocurrencies or any other financial asset. While the promise of high returns may be enticing, it is crucial to thoroughly research and verify the legitimacy of any investment opportunity before committing funds.

Furthermore, the case serves as a stark reminder of the perils of unchecked greed and hubris in the financial world. Peterson’s greed led not only to his own downfall but also to the ruin of an entire institution and the lives of many who trusted him. The 24-year prison sentence handed down to him underscores the gravity of his crimes and serves as a warning to others who may be tempted to follow in his footsteps.

In conclusion, the cryptocurrency pig-butchering scam that wrecked a Kansas bank and landed its ex-CEO in prison for 24 years is a cautionary tale of the dangers of financial fraud and the importance of ethical conduct in the world of banking and investments. It stands as a stark reminder that trust and integrity are the cornerstones of a successful financial system and that vigilance and accountability are essential to safeguarding the interests of all stakeholders.