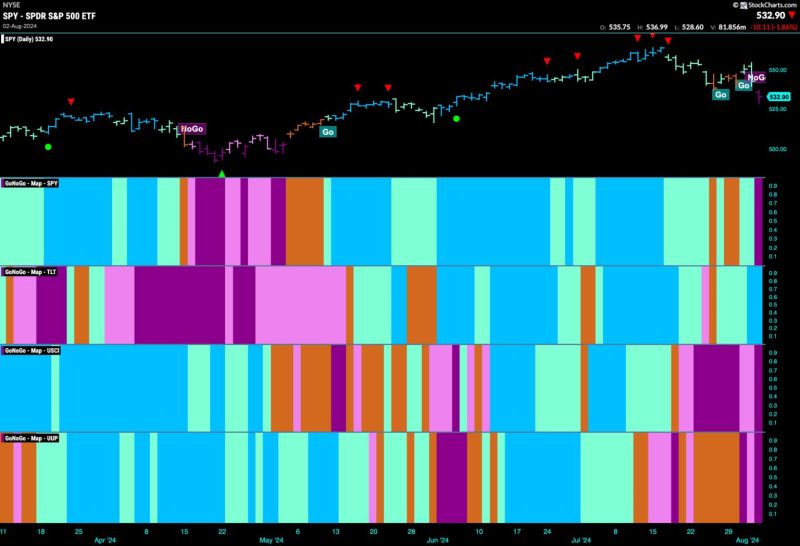

Stocks Get Defensive as Market Index Enters NoGo

—————————————————————

The recent shift in the market has seen stocks taking on a defensive stance as the market index enters a period of uncertainty. This change in strategy reflects a cautious approach by investors as they navigate through volatile economic conditions. In this article, we will explore the reasons behind this defensive positioning and the implications it may have on the broader market.

One of the key factors driving the defensive stance in stocks is the current economic backdrop characterized by global trade tensions, geopolitical uncertainties, and slowing economic growth. These factors have raised concerns among investors about the future direction of the market and the potential impact on corporate earnings. As a result, investors are turning to defensive stocks that are known for their stable performance during periods of economic turbulence.

Defensive stocks typically belong to industries such as utilities, healthcare, and consumer staples, which tend to be less cyclical and more resilient to economic downturns. These stocks are favored by investors for their steady cash flows, strong balance sheets, and reliable dividends. In times of market uncertainty, defensive stocks provide a safe haven for investors seeking stability and downside protection.

Another reason for the shift towards defensive stocks is the inverted yield curve, which has historically been a reliable predictor of an upcoming recession. When the yield curve inverts, long-term interest rates fall below short-term rates, signaling investor pessimism about the economy’s future prospects. In response to this warning signal, investors have been rotating their portfolios towards defensive stocks to shield themselves from potential market downturns.

Furthermore, the ongoing trade tensions between the U.S. and China have heightened market volatility and created a risk-off sentiment among investors. The uncertainty surrounding trade negotiations and the potential for further escalation in tariffs have driven investors towards defensive stocks as a way to reduce exposure to market risks associated with trade disputes.

As investors continue to position themselves defensively, the broader market is likely to experience increased volatility and a rotation towards defensive sectors. While defensive stocks may outperform during turbulent times, it is essential for investors to maintain a diversified portfolio that can weather market fluctuations and capture opportunities across different sectors.

In conclusion, the defensive stance adopted by investors in response to the current market environment reflects a prudent approach to risk management and capital preservation. By allocating to defensive stocks, investors can shield their portfolios from downside risks and navigate through uncertain market conditions. As the market index enters a period of uncertainty, staying informed and maintaining a disciplined investment strategy will be crucial for investors looking to mitigate risks and achieve long-term financial goals.