In the world of stock market analysis, investors have at their disposal a wide array of indicators and tools to help them navigate the complex and often unpredictable nature of the financial markets. One such indicator that has been gaining attention recently is the breadth indicator, a powerful tool that provides valuable insights into market sentiment and potential opportunities for investors.

The breadth indicator, also known as the market breadth indicator, measures the number of individual stocks that are participating in a market advance or decline. Essentially, it provides a broad view of market activity by analyzing the depth and breadth of the market’s movement. By tracking the number of stocks that are trending up or down, investors can gain a clearer understanding of market dynamics and potential shifts in sentiment.

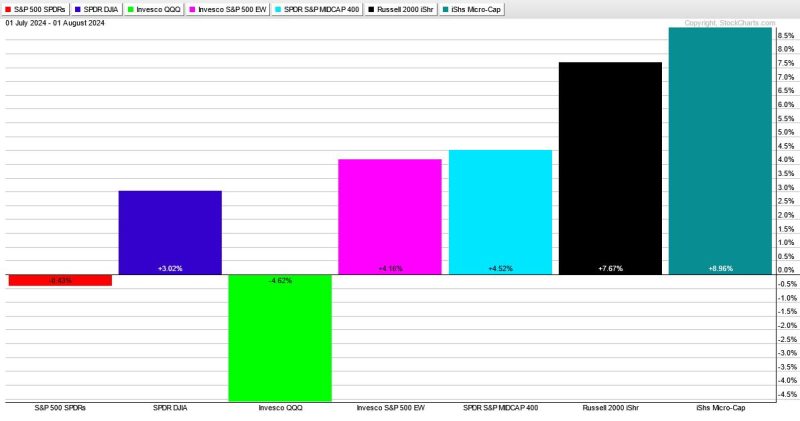

Recently, this breadth indicator has been pointing towards more downside in the market, indicating a potential opportunity for astute investors to capitalize on the looming market correction. As the indicator highlights a higher number of stocks in decline compared to those in an uptrend, it suggests that the market may be on the verge of a downward trend.

For investors, this can be a crucial signal to reassess their investment strategies and consider adjusting their portfolios to mitigate potential losses. By paying close attention to the breadth indicator, investors can stay ahead of market trends and position themselves to take advantage of the opportunities that arise during periods of market volatility.

While a market downturn can be unsettling for many investors, it also presents a unique opportunity to find bargains in the market and invest in undervalued stocks that have the potential for long-term growth. By using the breadth indicator as a guide, investors can make informed decisions about their investments and navigate the market with confidence.

In conclusion, the breadth indicator is a valuable tool for investors looking to understand market sentiment and identify potential opportunities in the market. By tracking the breadth of market movements, investors can gain valuable insights into market dynamics and position themselves to capitalize on emerging trends. With the help of this powerful indicator, investors can make more informed decisions about their investments and navigate the financial markets with greater confidence and success.