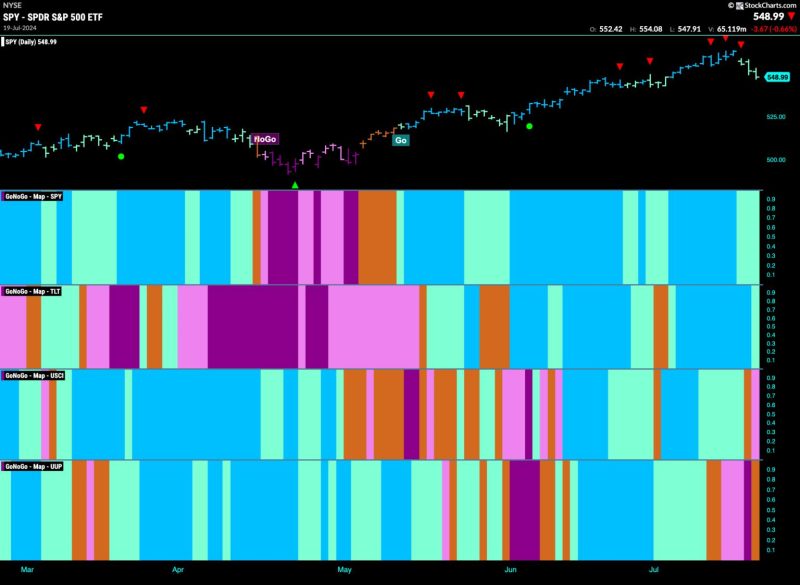

In the world of finance, trends are constantly evolving, and it’s crucial to stay informed about the latest developments to make sound investment decisions. Recently, there has been a notable shift in the market dynamics as financials begin to outperform while the equity go trend weakens. This shift has significant implications for investors and financial analysts alike, as it signals a potential change in the investment landscape.

Historically, equities have been a popular choice for investors seeking strong returns over the long term. However, the recent weakening trend in equities has raised concerns among market participants. As equity markets face challenges such as volatility and uncertainty, investors are turning to financials as a more stable and lucrative investment option.

The outperformance of financials can be attributed to several factors. Firstly, financial companies have been able to adapt to changing market conditions and implement strategies that have proven successful in generating profits. Additionally, the strong performance of financials can be linked to the overall health of the economy, as financial institutions tend to benefit from a growing and stable economic environment.

Another key driver of the outperformance of financials is the shift in investor sentiment. As equity markets exhibit signs of weakness, investors are seeking alternative investment opportunities that offer more stability and potential for growth. Financials have emerged as a favored choice for many investors due to their resilience in the face of market volatility.

The changing dynamics in the financial sector also reflect broader economic trends. As the global economy continues to recover from the impact of the pandemic, financial institutions are playing a crucial role in supporting economic growth and stability. This has bolstered confidence in financial stocks and contributed to their outperformance in the market.

Looking ahead, it is essential for investors to closely monitor these developments and adjust their investment strategies accordingly. While equities may still present opportunities for growth, the current shift towards financials suggests that diversifying investment portfolios with exposure to financial companies could prove beneficial in the long run.

In conclusion, the shift in market dynamics with financials outperforming while the equity go trend weakens underscores the importance of staying informed and adaptable in the ever-changing world of finance. By understanding these trends and their implications, investors can make informed decisions that align with their financial goals and risk tolerance. As the financial sector continues to evolve, being proactive and strategic in investment decisions will be key to navigating the complexities of today’s market environment.