In the world of trading and investing, technical analysis is often used to identify potential trends and patterns in financial markets. One such pattern that traders watch out for is the double top pattern, which can offer valuable insights into future price movements. In this article, we will explore the occurrence of a double top pattern on the Semiconductors ETF (SMH), analyzing its significance and potential implications for traders and investors.

### Understanding the Double Top Pattern

The double top pattern is a bearish technical reversal pattern that signals a potential change in trend from bullish to bearish. It consists of two peaks at approximately the same price level, separated by a trough. The pattern is completed when the price breaks below the level of the trough, indicating a shift in momentum from buying to selling pressure.

### Identifying the Double Top on SMH

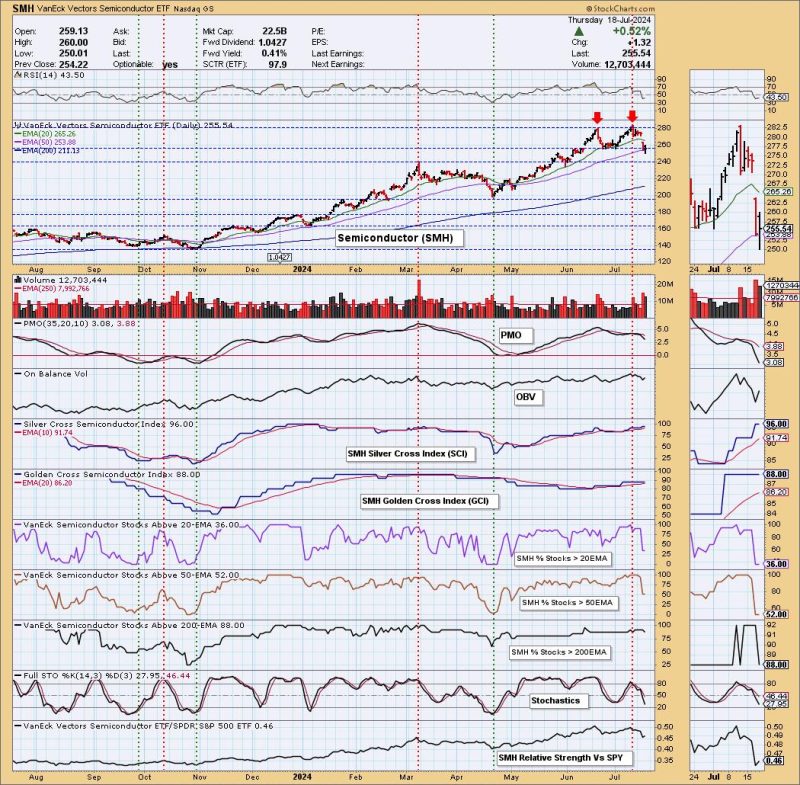

Analyzing the price chart of the Semiconductors ETF (SMH), we observe the formation of a double top pattern. The first peak occurred at a certain price level, followed by a retracement that formed a trough, and then a second peak near the same price level as the first peak. This formation indicates a potential reversal in the upward trend of SMH.

### Implications for Traders and Investors

For traders and investors, the occurrence of a double top pattern on SMH could signal a bearish outlook for the ETF. Traders who recognize this pattern may consider taking short positions to capitalize on the anticipated downward movement in price. Investors holding long positions in SMH may choose to exercise caution and monitor the situation closely to decide whether to adjust their positions or take profits.

### Risk Management and Confirmation

As with any technical pattern, it is essential to consider risk management strategies when trading based on the double top pattern. Traders should set stop-loss orders to limit potential losses in case the price reverses unexpectedly. Additionally, it is recommended to wait for a confirmation of the pattern, such as a clear break below the trough level, before entering a trade to reduce false signals.

### Conclusion

In conclusion, the presence of a double top pattern on the Semiconductors ETF (SMH) suggests a potential reversal in the upward trend, signaling a bearish outlook for the ETF. Traders and investors can leverage this pattern to make informed decisions about their positions, implementing risk management strategies and waiting for confirmation before taking action. By understanding and utilizing technical analysis patterns like the double top, market participants can improve their trading outcomes and enhance their investment strategies.