The Hindenburg Omen: Understanding Its Significance in Market Analysis

Market analysts and investors are always on the lookout for signals and indicators that can provide insights into potential market movements. One such indicator that has gained attention in recent years is the Hindenburg Omen. It is considered by some to be a powerful signal that may indicate a change in market sentiment and potential future volatility.

The Hindenburg Omen is named after the German airship disaster of 1937 and was first introduced by Jim Miekka, a mathematician and stock market analyst. This technical indicator is based on a series of market data points and is designed to identify instances when the stock market is vulnerable to a sharp decline.

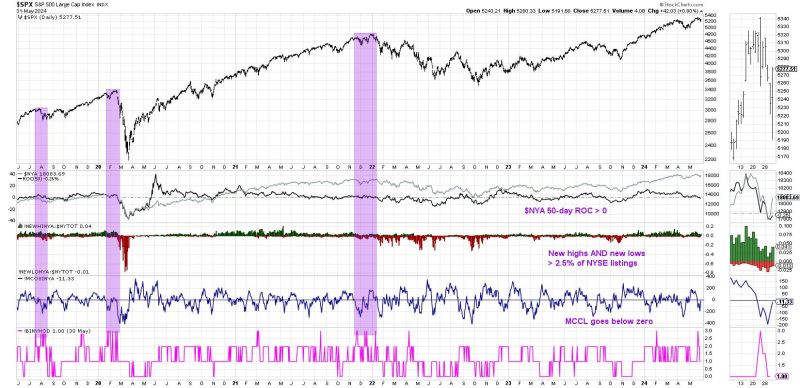

To trigger a Hindenburg Omen, a set of specific criteria must be met simultaneously. These criteria typically include a high number of stocks hitting 52-week highs and lows, a rising 10-week moving average, and a weakening McClellan Oscillator. When these conditions are met, it is considered a warning sign of potential market turmoil.

However, it is important to note that the Hindenburg Omen is not foolproof and has its limitations. Some critics argue that the indicator has a high rate of false signals and can sometimes provide conflicting information. Additionally, market conditions and dynamics can vary, making it challenging to rely solely on one indicator for making investment decisions.

Despite its limitations, many analysts still pay attention to the Hindenburg Omen as part of a broader toolkit for assessing market conditions. It is often used in conjunction with other technical indicators and fundamental analysis to gain a more comprehensive view of the market.

Ultimately, understanding the Hindenburg Omen requires a careful analysis of market data and a consideration of the broader economic landscape. While it may not be a crystal ball for predicting market movements, it can serve as a valuable tool for investors looking to navigate the complexities of the stock market.

In conclusion, the Hindenburg Omen is a technical indicator that has garnered attention for its potential to signal market downturns. While its reliability may be debated, it remains a useful tool for investors who are diligent in their analysis and utilize it alongside other indicators and research. As with any investment strategy, a holistic approach that considers multiple factors is key to making informed decisions in the ever-changing landscape of the stock market.