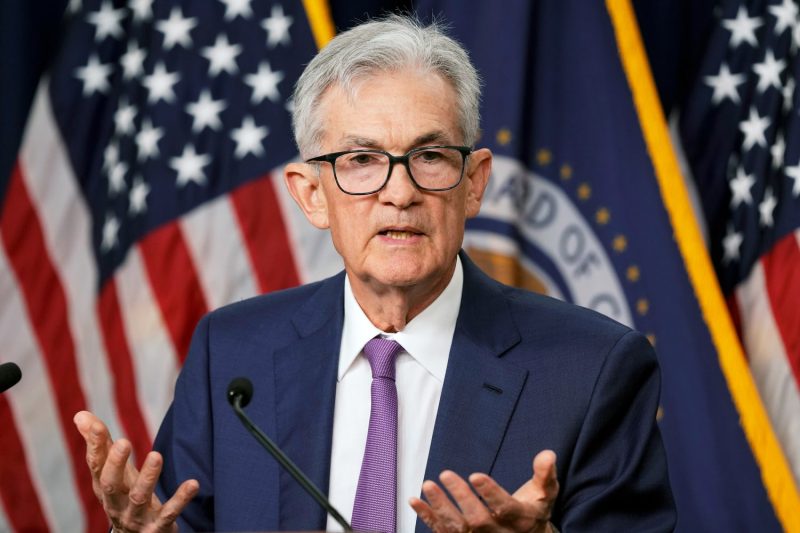

In a recent statement, Federal Reserve Chair Jerome Powell shed light on the current inflation situation in the United States and provided insights into the Federal Reserve’s monetary policy stance. Powell acknowledged that inflation levels have been higher than initially anticipated, prompting concerns in the financial markets.

Powell’s comments come at a time when many economists and analysts have been closely monitoring inflation data amid a rapidly changing global economic landscape. The Federal Reserve has been closely monitoring key economic indicators, including inflation rates, to guide its decision-making on interest rates and other monetary policy tools.

The unexpected rise in inflation has been driven by several factors, including supply chain disruptions, pent-up consumer demand, and a surge in commodity prices. These elements have created a challenging environment for policymakers, who must strike a delicate balance between supporting economic growth and keeping inflation in check.

Despite the increase in inflation, Powell expressed confidence in the Federal Reserve’s ability to manage the situation effectively. He emphasized the central bank’s commitment to achieving its dual mandate of fostering maximum employment and maintaining stable prices. Powell reiterated that the Federal Reserve would take the necessary steps to ensure that inflation remains under control while supporting the ongoing economic recovery.

One key aspect of the Federal Reserve’s response to elevated inflation levels is its approach to interest rates. Powell indicated that the Federal Reserve intends to keep interest rates steady for the time being, allowing the economy to continue its path to recovery. By maintaining stable interest rates, the Federal Reserve aims to provide businesses and consumers with certainty and stability in uncertain times.

Looking ahead, Powell underscored the importance of ongoing economic data analysis to guide future policy decisions. The Federal Reserve will continue to closely monitor inflation trends, labor market conditions, and other macroeconomic indicators to inform its policy stance. Powell emphasized the need for flexibility and adaptability in responding to changing economic conditions, highlighting the Federal Reserve’s commitment to fostering a strong and resilient economy.

Overall, Powell’s remarks provide valuable insights into the Federal Reserve’s current thinking on inflation and monetary policy. As the economy navigates through a period of heightened uncertainty, policymakers face the challenge of maintaining economic stability while addressing the impacts of higher inflation. By remaining vigilant and proactive in their approach, the Federal Reserve aims to steer the economy towards sustainable growth and prosperity.