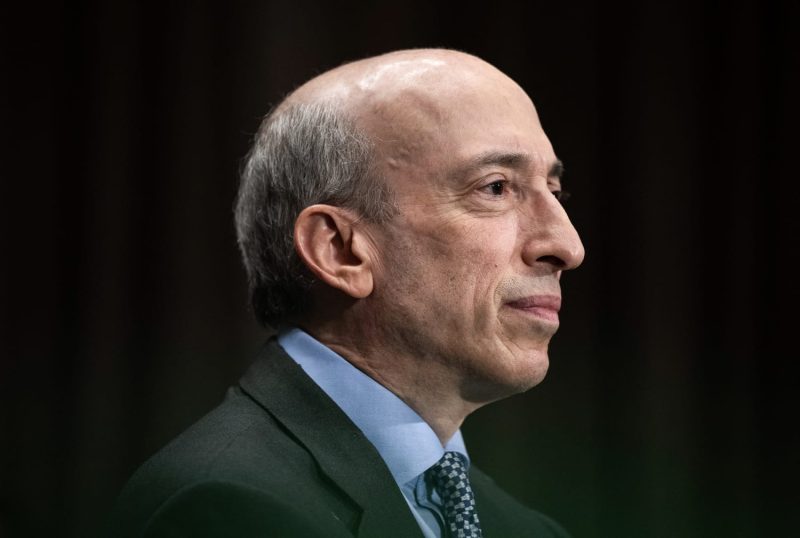

In a surprising turn of events, Securities and Exchange Commission (SEC) Chair Gary Gensler has announced his upcoming resignation, effective January 20. Gensler’s departure marks the end of his eventful tenure as head of the SEC, during which he focused on enhancing regulations and oversight in the financial sector. Gensler’s decision to step down has triggered speculation about his replacement, with former President Donald Trump reportedly eyeing a potential candidate to fill the vacant position.

During his time as SEC Chair, Gensler made significant strides in implementing measures aimed at increasing transparency and accountability in financial markets. Gensler’s background as a former Wall Street regulator and his strong stance on investor protection were instrumental in shaping his approach to regulating the securities industry. Under his leadership, the SEC pursued various initiatives to address market manipulation, corporate misconduct, and the protection of retail investors.

One notable aspect of Gensler’s tenure was his emphasis on regulating cryptocurrencies and digital assets. As the popularity and adoption of cryptocurrencies surged, Gensler recognized the need for robust oversight to mitigate risks and safeguard investors. He advocated for clearer guidelines on the trading and issuance of digital assets, signaling the SEC’s intention to bring greater regulatory clarity to the crypto market.

Gensler’s departure has raised questions about the future direction of the SEC under new leadership. With the possibility of a Trump-appointed successor on the horizon, industry experts are scrutinizing the potential implications for financial regulation and enforcement priorities. The choice of Gensler’s replacement will be closely watched as it could signal a shift in the SEC’s approach to key issues such as crypto regulation, market surveillance, and enforcement actions against misconduct.

As the financial landscape continues to evolve, the selection of the next SEC Chair will play a crucial role in shaping the regulatory environment for years to come. The incoming chair will face the formidable task of navigating complex market dynamics, technological innovations, and regulatory challenges while upholding the SEC’s mandate to protect investors and maintain fair and efficient markets.

In conclusion, Gary Gensler’s impending departure from the SEC marks the end of an era characterized by a proactive approach to regulatory oversight and investor protection. As the financial industry braces for a new chapter under fresh leadership, the selection of Gensler’s successor will be a pivotal moment with far-reaching implications for the future of financial regulation in the United States.