The world of semiconductor exchange-traded funds (ETFs) offers investors a diverse range of options to gain exposure to this innovative and rapidly evolving industry. Two key players in this space are the VanEck Vectors Semiconductor ETF (SMH) and the iShares PHLX Semiconductor ETF (SOXX). While both ETFs provide investors with access to semiconductor companies, there are key differences in their holdings and performance that contribute to their varying levels of resilience.

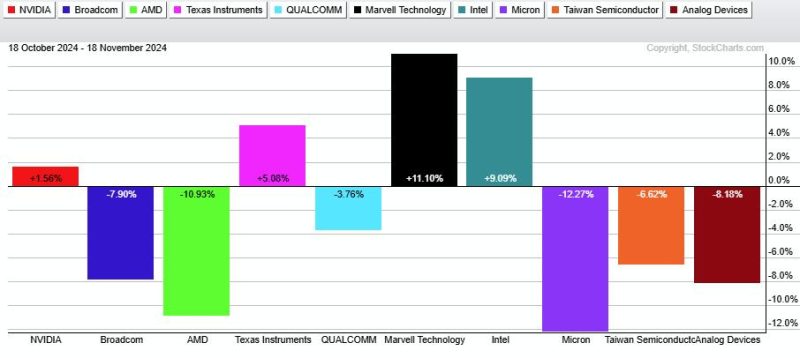

One notable difference between SMH and SOXX is their respective top holdings. SMH, as of the time of writing, has a significant allocation to companies such as Taiwan Semiconductor Manufacturing Company (TSMC), NVIDIA Corporation, and Intel Corporation. These companies have played a crucial role in driving SMH’s performance, with TSMC’s position as a leading semiconductor foundry and NVIDIA’s strength in graphics processing units contributing to the fund’s solid performance.

On the other hand, SOXX boasts a different set of top holdings, including companies such as Intel Corporation, NVIDIA Corporation, and Broadcom Inc. While there is some overlap with SMH in terms of holdings, the differing weightings and allocation strategies have influenced SOXX’s performance compared to SMH. For instance, Intel’s presence as a top holding in both ETFs highlights its importance to the semiconductor industry but also underscores the different weighting methodologies employed by the two funds.

Another factor that sets SMH apart from SOXX is its sector allocation. SMH has a greater focus on specific subsectors within the semiconductor industry, such as fabless semiconductor companies and semiconductor equipment manufacturers. This targeted approach has contributed to SMH’s ability to weather market volatility and outperform SOXX in certain periods.

Additionally, the weighting methodology used by SMH and SOXX can impact their performance during market fluctuations. For instance, SMH’s equal-weighted approach helps to diversify risk across its holdings, potentially providing more stability during times of market uncertainty. In contrast, SOXX’s market-cap-weighted methodology may result in higher concentrations in certain stocks, which can lead to more volatility in its performance.

Overall, the tale of these two semiconductor ETFs highlights the importance of researching and understanding the specific characteristics of each fund before making investment decisions. While both SMH and SOXX offer exposure to the semiconductor industry, their differing holdings, sector allocations, and weighting methodologies can lead to varying performance outcomes. By examining these factors and staying informed about industry developments, investors can make better-informed decisions when choosing between SMH and SOXX or incorporating them into their investment portfolio.