The link provided gives insight into the current market conditions and signals of a short-term bearish trend as investors anticipate significant news events. Let’s delve into the reasons behind this sentiment and explore the implications for traders and investors.

Market participants are currently bracing themselves for a week filled with potentially market-moving news events, including economic data releases, corporate earnings reports, and geopolitical developments. Such events can introduce uncertainty and volatility into the markets, prompting caution among traders and investors.

One key factor contributing to the bearish sentiment is the anticipation of economic data releases that could shed light on the state of the economy. Indicators such as job reports, inflation data, and retail sales figures provide valuable insights into the health of the economy and can influence market sentiment. Any surprises or deviations from expectations in these reports can lead to sharp market movements.

Corporate earnings season is another significant driver of market volatility. Companies’ financial performance and outlook can sway investor sentiment and impact stock prices. If companies report weaker-than-expected earnings or issue downbeat guidance, it could trigger selling pressure and contribute to a bearish outlook.

Geopolitical events also play a crucial role in shaping market sentiment. Developments such as trade tensions, political instability, or global conflicts can introduce uncertainty and risk aversion among investors. Any escalations or unexpected twists in these events could exacerbate market volatility and drive investors towards safe-haven assets.

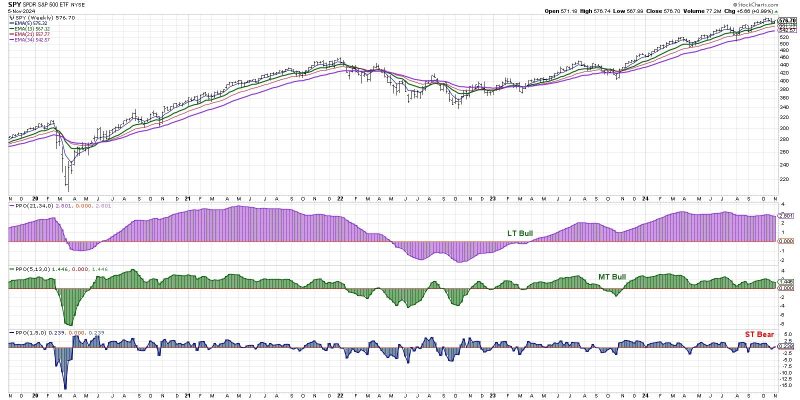

Furthermore, technical indicators are signaling a potential short-term bearish trend in the markets. Analysis of market charts, trend lines, and key support and resistance levels can provide valuable insights into potential market movements. Traders often rely on technical analysis to make informed trading decisions and navigate market volatility.

In light of these factors, traders and investors should exercise caution and stay informed about upcoming news events. It is essential to remain vigilant, manage risk effectively, and be prepared for potential market turbulence. Diversification, proper risk management strategies, and staying abreast of market developments can help mitigate the impact of short-term bearish signals and navigate uncertain market conditions successfully.

In conclusion, the current market environment is characterized by heightened uncertainty and caution as investors brace for a news-heavy week. By understanding the factors driving the bearish sentiment, staying informed about upcoming events, and employing sound trading strategies, traders and investors can navigate market volatility effectively and position themselves for long-term success.