The article Week Ahead: While Nifty Consolidates, Keep Head Above These Levels Crucial outlines the key levels and trends to watch for in the Indian stock market in the upcoming week. As investors navigate the current market conditions, it is imperative to remain mindful of the crucial levels and indicators that can influence trading decisions.

The Nifty index has been consolidating in a range, suggesting a period of indecision among market participants. During such times, it is essential for traders to closely monitor specific support and resistance levels to gauge the market’s direction. The support levels around 14,300 and 14,100 are crucial for maintaining the current consolidation phase and could indicate a potential reversal in sentiment if breached.

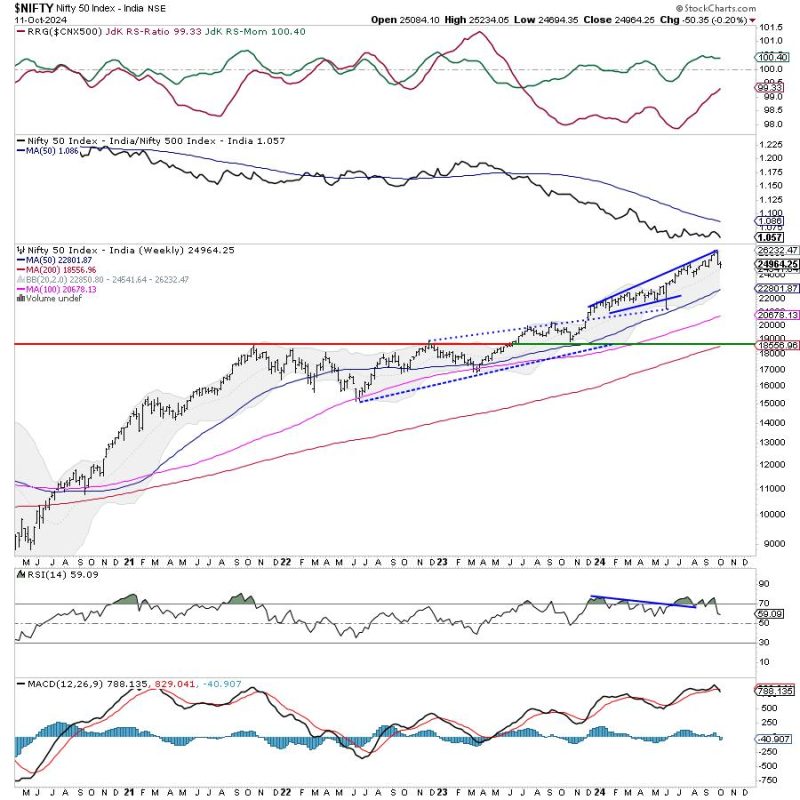

Additionally, the article highlights the importance of technical indicators such as the Relative Strength Index (RSI) and Moving Averages in interpreting market trends. These tools can provide valuable insights into the momentum and strength of the market, guiding traders in their decision-making process.

Furthermore, the article emphasizes the significance of global cues and macroeconomic factors in influencing market sentiment. With increasing volatility and uncertainty in the global markets, it is essential for investors to remain vigilant and adapt their strategies accordingly.

In conclusion, the article serves as a comprehensive guide for investors looking to navigate the Indian stock market in the upcoming week. By staying informed about key levels, technical indicators, and external factors, traders can make well-informed decisions and better position themselves in the ever-changing market landscape.