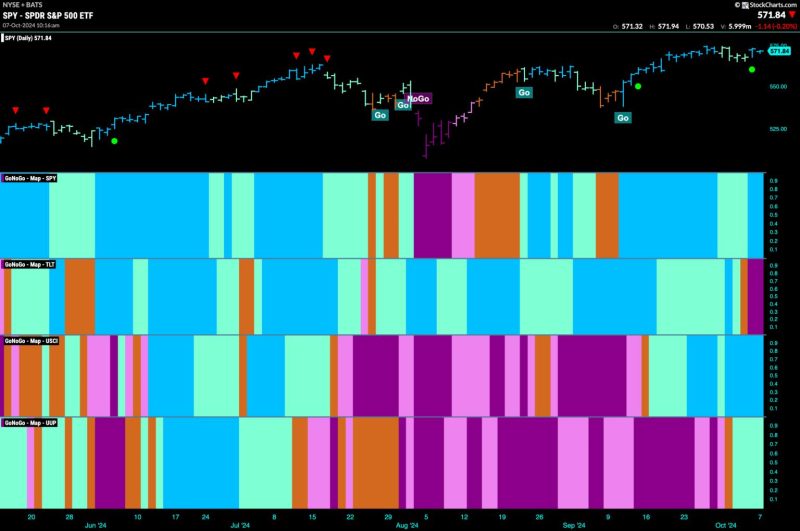

Equities Remain in ‘Go’ Trend and Lean into Energy

The global equities market continues to show strength as investors confidently lean into energy stocks. The current trend is clearly towards a ‘Go’ attitude as market participants emphasize risk-taking and growth opportunities. This bullish sentiment is further fueled by strong economic data, positive earnings reports, and potential policy changes that favor certain sectors.

One key area where investors are particularly focusing their attention is the energy sector. Energy stocks have seen a notable increase in interest and investment as countries around the world ramp up efforts towards cleaner and more sustainable energy sources. Investors are also eyeing the potential for increased demand as global economies rebound from the impact of the pandemic.

Renewable energy companies, in particular, have been gaining traction among investors looking for sustainable long-term growth opportunities. With increased government support and growing consumer awareness of climate change, companies in the renewable energy space are well-positioned to benefit from shifting market dynamics.

The traditional energy sector, including oil and gas companies, has also seen a resurgence in interest. As global demand for energy continues to rise, these companies are poised to benefit from increased production and higher prices. Additionally, advancements in technology and efficiency are helping traditional energy companies improve their environmental footprint and overall sustainability.

Economic data has been largely positive, with many countries reporting strong growth numbers and improving employment figures. This has further bolstered investor sentiment and confidence in the equity markets. As economies continue to recover, equities are likely to remain in a ‘Go’ trend as investors seek out opportunities for growth and higher returns.

Policy changes are also playing a significant role in shaping investor behavior and equity market trends. Governments are increasingly focusing on green initiatives and sustainability goals, which is driving investment towards environmentally-friendly companies. Investors are aligning their portfolios with these policy changes, favoring companies that are well-positioned to benefit from the transition to a more sustainable economy.

In conclusion, the current state of the global equities market is characterized by a ‘Go’ trend, with investors showing a strong appetite for risk-taking and growth opportunities. The energy sector, both traditional and renewable, is a key area of focus as investors lean into companies that are well-positioned to benefit from shifting market dynamics. Positive economic data, policy changes, and investor sentiment are all contributing to the bullish outlook for equities, signaling a continued trend towards growth and opportunity in the market.