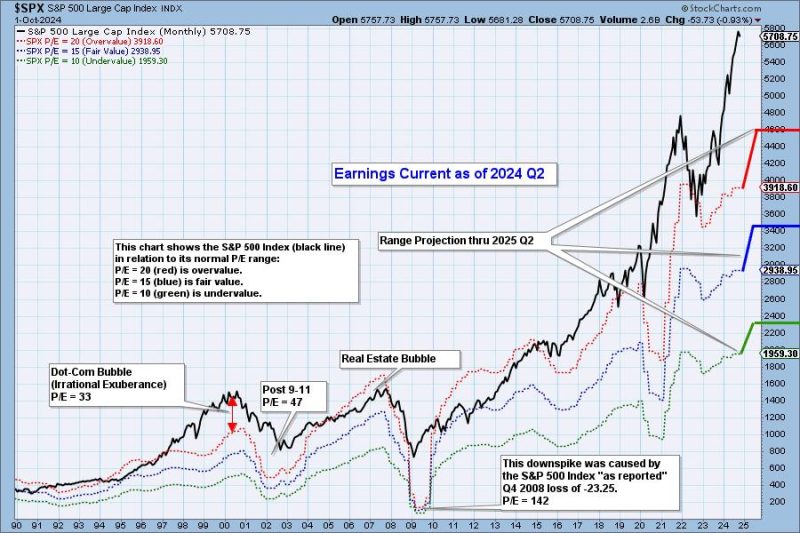

In the ever-evolving landscape of financial markets, the evaluation of stock market valuation remains a key concern for investors and analysts alike. As the rollercoaster of economic indicators continues to shift, the most recent data from the 2024 Q2 earnings reports paints a complex picture of market conditions. However, despite the nuances of these findings, a prevailing sentiment persists – the market remains very overvalued.

Analyzing the 2024 Q2 earnings across various sectors reveals a mixed bag of results. While some companies exceeded expectations and reported robust growth, a significant number struggled to meet projections. This disparity reflects the broader trend of market volatility, where external factors such as geopolitical tensions and supply chain disruptions have created challenges for businesses of all sizes.

One key takeaway from the 2024 Q2 earnings season is the divergence between strong corporate performance and market valuation. Many companies have posted record profits and healthy growth metrics, yet their stock prices do not necessarily reflect this success. This disconnect has raised concerns among investors, who fear that the market may be pricing in unrealistic expectations and potentially setting the stage for a correction.

Moreover, the growing prevalence of speculative trading and trendy stocks has further inflated market valuations. The rise of meme stocks and cryptocurrency mania has led to a surge in speculative behavior, fueling a wave of market exuberance that may not be rooted in fundamental economic principles. As a result, the gap between market valuation and actual performance continues to widen, prompting caution among seasoned investors.

The Federal Reserve’s monetary policy and interest rate decisions also play a crucial role in shaping market valuations. The central bank’s efforts to stimulate economic growth through low interest rates and asset purchases have provided a significant boost to stock prices. However, the risk of inflation and the potential for future rate hikes loom large, casting a shadow of uncertainty over the market’s long-term outlook.

In light of these factors, investors are urged to exercise vigilance and maintain a diversified portfolio that can weather the storm of market volatility. As the 2024 Q2 earnings reports underscore the challenges and opportunities that lie ahead, a cautious approach to investment decisions is paramount. By staying informed, adapting to changing market conditions, and seeking expert advice, investors can navigate the maze of overvalued markets with prudence and foresight.