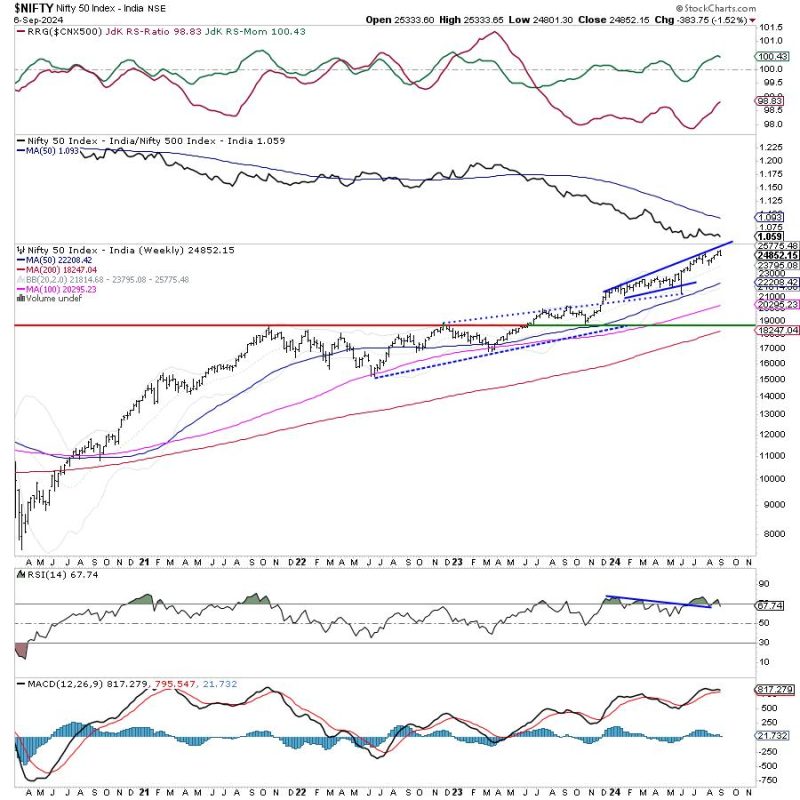

The article presents a detailed analysis of the Nifty index, focusing on the early signs of potential disruption to its uptrend. These indicators serve as a cautionary signal to investors and traders, prompting them to carefully consider their strategies and positions in the market.

The analysis begins by highlighting the Nifty’s recent performance, noting the index’s gradual decline following a strong uptrend. This shift in momentum raises concerns about the sustainability of the current bullish market sentiment. As observed by market experts, these weakening signs suggest a potential reversal in the coming days.

The article delves into the technical aspects of the Nifty index, examining key support and resistance levels that play a crucial role in determining the market’s trajectory. By closely monitoring these levels, market participants can gain valuable insights into potential price movements and adjust their trading decisions accordingly.

Furthermore, the article discusses the impact of external factors, such as global economic trends and geopolitical events, on the Nifty index. These macroeconomic influences can significantly affect market sentiment and contribute to increased volatility, further underscoring the need for caution in the current trading environment.

In addition to technical analysis, the article emphasizes the importance of risk management strategies in navigating uncertain market conditions. By diversifying their portfolios, setting stop-loss orders, and staying informed about market developments, investors can mitigate potential losses and protect their capital during periods of heightened volatility.

Overall, the article serves as a timely reminder for investors and traders to exercise caution and prudence in their decision-making processes. By staying vigilant, adapting to changing market dynamics, and implementing sound risk management practices, market participants can navigate potential disruptions and safeguard their financial interests in the face of evolving market conditions.