In the current market scenario, the Nifty seems to be adopting a more defensive stance as a tentative atmosphere prevails. Various levels of significance have emerged that traders and investors need to be aware of in order to navigate the market effectively.

Key Levels to Watch:

1. The Nifty has been trading in a narrow range, with resistance at around 12,150 levels. This level has proved to be a significant barrier in recent sessions, indicating a cautious approach among market participants.

2. On the downside, the 11,900 level has acted as crucial support, preventing any substantial decline. Breaching this support could signal further downside potential for the index.

3. The broader market sentiment remains uncertain, with mixed signals from global markets and domestic factors contributing to the cautious outlook.

Sectoral Analysis:

1. Defensive sectors such as IT, Pharma, and FMCG have shown resilience in the face of market volatility. Investors are seeking safety in these sectors, resulting in a defensive setup in the market.

2. On the other hand, sectors like Banking and Auto have faced challenges due to economic slowdown concerns and regulatory changes. These sectors may continue to underperform until clarity emerges on policy fronts.

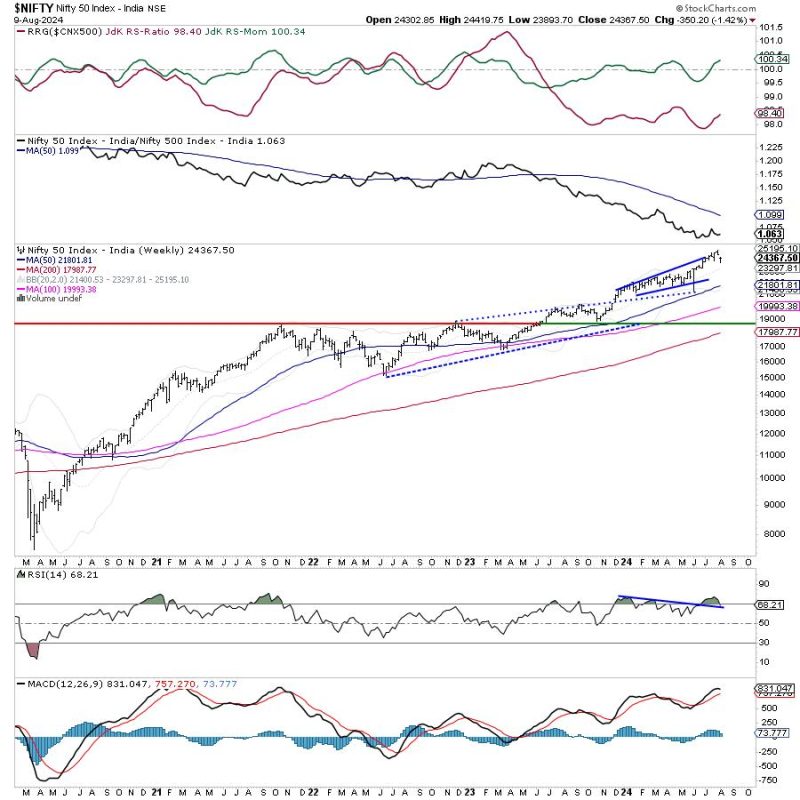

Technical Indicators:

1. Majority of technical indicators are signaling caution, with momentum indicators remaining flat and moving averages giving mixed signals.

2. The MACD indicator is hovering near the zero line, suggesting indecision among market participants. Traders need to be cautious and nimble in their approach given the current technical setup.

Market Outlook:

1. With global economic uncertainties looming large and domestic factors adding to the cautious sentiment, the market is likely to remain range-bound in the near term.

2. Investors should adopt a defensive strategy by focusing on resilient sectors and quality stocks while avoiding high-risk investments in the current environment.

In conclusion, the Nifty’s tentative stance and developing defensive setup highlight the need for investors to stay informed and adapt their strategies accordingly. By monitoring key levels, sectoral trends, and technical indicators, market participants can navigate the current landscape with prudence and agility.