In the world of global finance and economic landscapes, the NASDAQ stands out as a significant barometer of the stock market’s health and stability. This pivotal technology-focused exchange is closely monitored by investors, analysts, and traders alike, as its movements often reflect broader market sentiments and trends. The current state of the NASDAQ is under intense scrutiny, as critical levels are being closely watched to gauge the index’s resiliency amidst uncertain economic conditions.

One of the key critical levels that experts are closely monitoring is the NASDAQ’s support level. Support levels act as a safety net for an index or stock, indicating the price level at which significant buying interest can be expected. If the NASDAQ breaches this vital support level, it could signal a bearish trend, prompting further selling pressure and potential market downturns.

Technical analysts are also keeping a keen eye on the NASDAQ’s resistance levels, which represent the upper boundary of the index’s price movement. If the NASDAQ fails to break through these resistance levels, it could indicate a lack of bullish momentum and potentially lead to a consolidation phase or even a reversal in the index’s direction.

The Relative Strength Index (RSI) is another critical metric being closely followed by market observers. The RSI measures the magnitude and velocity of an index’s recent price movements, providing valuable insights into whether an index is overbought or oversold. An RSI reading above 70 suggests that the index may be overbought, while a reading below 30 indicates potential oversold conditions. Monitoring the NASDAQ’s RSI can help analysts anticipate potential trend reversals and market corrections.

Volatility levels are also a crucial factor to consider when assessing the NASDAQ’s stability and direction. High volatility can lead to sharp price swings and increased risk, while low volatility may signal a lack of market interest and trading opportunities. By tracking the NASDAQ’s volatility, investors can adjust their trading strategies and risk management techniques accordingly to navigate turbulent market conditions effectively.

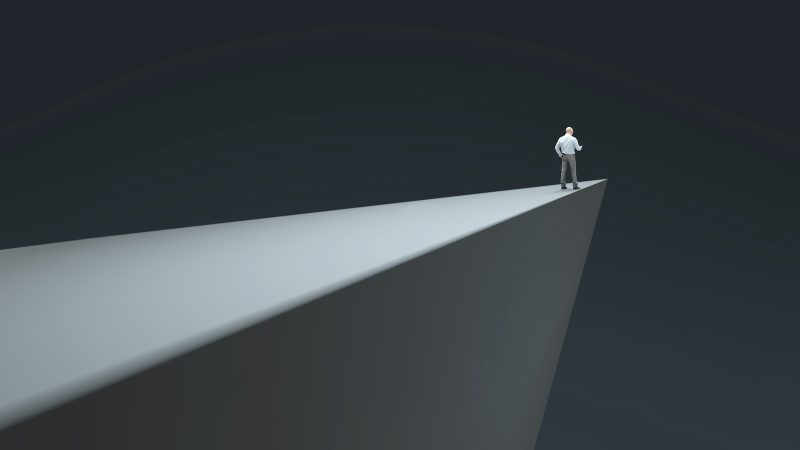

In conclusion, the NASDAQ’s current precarious position on critical levels underscores the importance of vigilance and strategic decision-making in today’s dynamic financial markets. By closely monitoring key support and resistance levels, analyzing technical indicators like the RSI, and gauging market volatility, investors can better position themselves to capitalize on opportunities and mitigate risks in an ever-changing investment landscape. As the NASDAQ teeters on the edge, astute investors stand ready to navigate uncertain market waters with resilience and foresight.