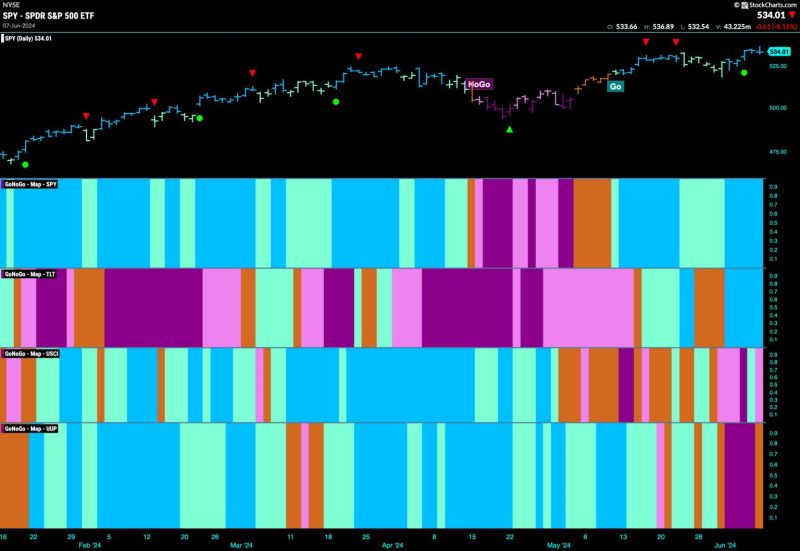

Equities Hit New All-Time Highs as Communications Joins Leadership Party

Equities across various sectors have been surging to new all-time highs recently, with the communications sector notably joining the leadership party. This trend has sparked optimism among investors and analysts, signaling a bullish sentiment in the market. Let’s delve deeper into the factors driving this momentum and what it means for the broader market landscape.

One key factor contributing to the rally in equities is the overall positive sentiment surrounding the economy. With unemployment rates declining and consumer confidence on the rise, investors are more optimistic about the prospects for businesses across different sectors. This optimism has translated into increased demand for equities, with investors seeking higher returns in a low-interest-rate environment.

The communications sector, in particular, has emerged as a standout performer in recent weeks. Companies within this sector, including major players in telecommunications, media, and technology, have seen strong growth in their stock prices. The increasing reliance on digital connectivity and communication channels has boosted the prospects for companies in this sector, driving investor interest and pushing valuations higher.

Another significant driver of the equity rally is the ongoing earnings season, where many companies have reported better-than-expected earnings results. These positive earnings surprises have provided further fuel for the market rally, as investors gain confidence in the resilience and growth potential of businesses across various sectors.

Furthermore, the Federal Reserve’s commitment to maintaining accommodative monetary policies has also played a role in supporting the equity markets. The central bank’s pledge to keep interest rates low and continue its asset purchase programs has provided a supportive backdrop for risky assets like equities, encouraging investors to allocate capital to the stock market.

Amidst this backdrop of positive economic data, strong earnings reports, and accommodative monetary policies, equities have continued to hit new all-time highs. While some investors may express concerns about the potential for a market correction, the prevailing sentiment remains largely optimistic, with many analysts expecting the rally to persist in the near term.

In conclusion, the recent surge in equities to new all-time highs, with the communications sector emerging as a key leader, reflects the overall bullish sentiment in the market. Factors such as positive economic data, strong earnings reports, and supportive monetary policies have all contributed to this momentum. While risks of a market correction exist, the prevailing optimism suggests that the equity rally may have further room to run in the coming weeks. Investors should remain vigilant and stay attuned to market developments as they navigate this evolving landscape.