The article below draws insights from the reference link provided and presents a unique perspective on the topic.

—

**Market Sentiment: Topping Out or Temporary Pause?**

**Current Market Overview**

The recent performance of the stock market has been characterized by uncertainty and volatility. Investors are closely monitoring significant indices and indicators, trying to gauge whether the market is reaching its peak or if the current downturn is a temporary correction. With continuous fluctuations in stock prices and conflicting economic data, the mood among investors is cautious yet optimistic.

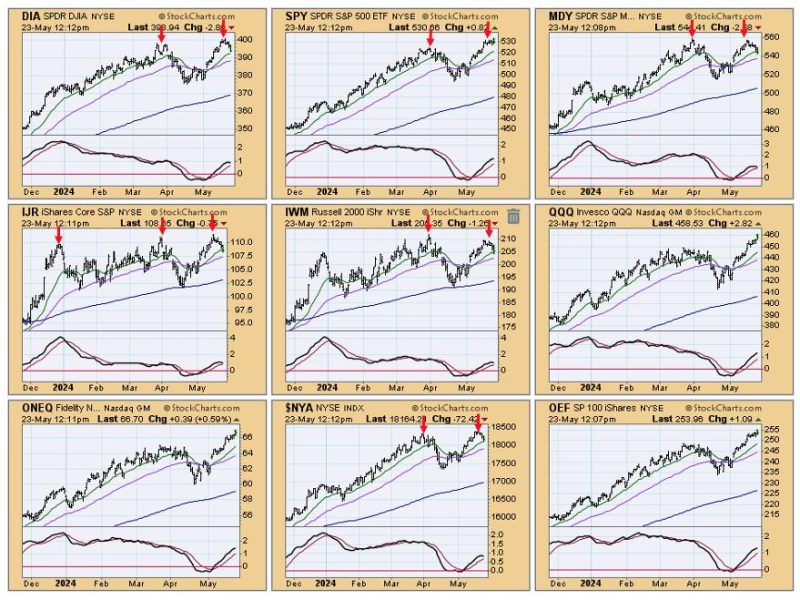

**Technical Analysis**

Technical analysts are paying close attention to charts and trend patterns to determine the market direction. The presence of a topping out formation, as seen in several key stocks and indices, suggests a potential reversal in the upward trend. However, some analysts argue that these patterns may be indicative of a temporary pause rather than a definitive market peak.

**Fundamental Factors**

Factors such as rising interest rates, inflation concerns, geopolitical tensions, and supply chain disruptions are contributing to the uncertain market sentiment. While these factors may signal potential risks for investors, strong corporate earnings and economic growth prospects are also supporting market resilience.

**Investor Psychology**

Investor psychology plays a crucial role in determining market trends. Fear and greed often drive market behavior, leading to irrational decisions and herd mentality. As investors navigate through uncertain times, maintaining a balanced and rational approach to investing becomes essential to avoid knee-jerk reactions.

**Risk Management**

In times of market uncertainty, risk management strategies become paramount. Diversification, asset allocation, and setting clear investment goals are essential practices to mitigate risks and maximize returns. Investors should also consider their risk tolerance and time horizon when making investment decisions.

**Conclusion**

In conclusion, the debate over whether the market is topping out or experiencing a temporary pause continues to divide opinions among analysts and investors. While technical indicators and fundamental factors provide valuable insights, investor psychology and risk management strategies are equally important in navigating through uncertain market conditions. By staying informed, disciplined, and focused on long-term goals, investors can weather market fluctuations and make well-informed investment decisions.

—

This article provides a balanced perspective on the current market situation, emphasizing the importance of a cautious yet rational approach to investing in times of uncertainty.