In the world of finance and investing, security ranking measures play a crucial role in formulating effective money management strategies. Investors and fund managers rely on these measures to assess the risk and potential returns associated with various investment options. By using quantitative methodologies and data analysis techniques, security ranking measures help in making informed decisions and optimizing portfolio performance.

One key aspect of security ranking measures is their ability to provide a systematic and objective way of evaluating securities. Unlike subjective assessments, which can be influenced by emotions or biases, ranking measures are based on clear criteria and metrics. This allows investors to compare different investment opportunities on a level playing field and select those that best align with their investment objectives and risk tolerance.

Among the various security ranking measures commonly used in the financial industry, one of the most popular is the Sharpe ratio. The Sharpe ratio measures the risk-adjusted return of an investment by taking into account both the return generated and the level of risk involved. A higher Sharpe ratio indicates better risk-adjusted performance, making it a valuable tool for assessing the efficiency of an investment strategy.

Another important security ranking measure is the Sortino ratio, which is a variation of the Sharpe ratio that focuses on the downside risk of an investment. Unlike the Sharpe ratio, which considers total volatility, the Sortino ratio only looks at the volatility of negative returns. This makes it particularly useful for investors who are more concerned about protecting their portfolio from losses.

In addition to risk-adjusted measures like the Sharpe and Sortino ratios, security ranking measures also include fundamental analysis metrics such as price-to-earnings (P/E) ratio, earnings per share (EPS) growth, and dividend yield. These metrics provide valuable insights into the financial health and performance of a company, helping investors identify opportunities with strong fundamentals and growth potential.

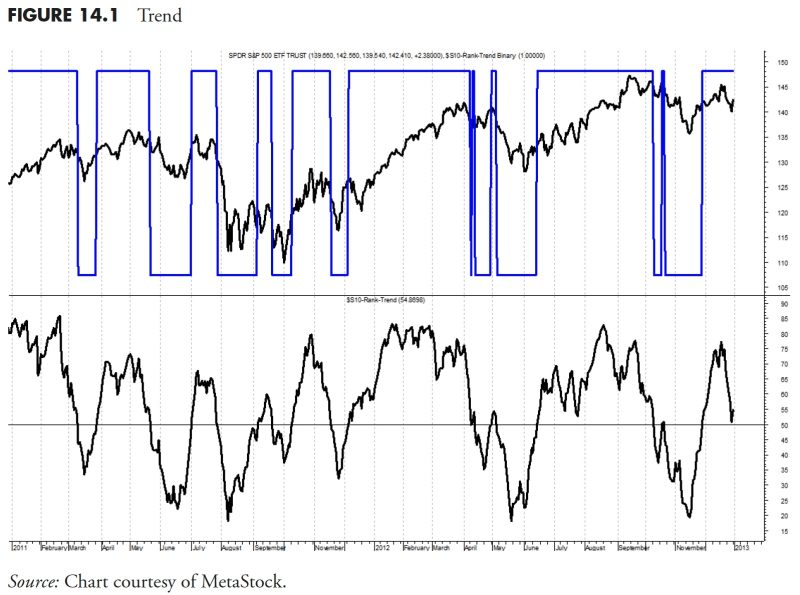

Technical analysis indicators also play a significant role in security ranking measures, providing insights into market trends, price movements, and trading patterns. Common technical indicators include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). By analyzing these indicators, investors can identify potential entry and exit points for their trades, as well as assess the overall market sentiment.

Overall, security ranking measures are essential tools for investors looking to construct well-balanced and diversified portfolios. By leveraging these measures, investors can enhance their understanding of the various risk and return characteristics of different securities, make more informed investment decisions, and ultimately improve their long-term investment performance. In a rapidly changing financial landscape, where market volatility and uncertainty are ever-present, security ranking measures provide a structured and systematic approach to managing investment risks and achieving financial success.