Certainly! Here is the structured article based on the reference link you provided:

—

**Top 6 Copper Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs) for 2024**

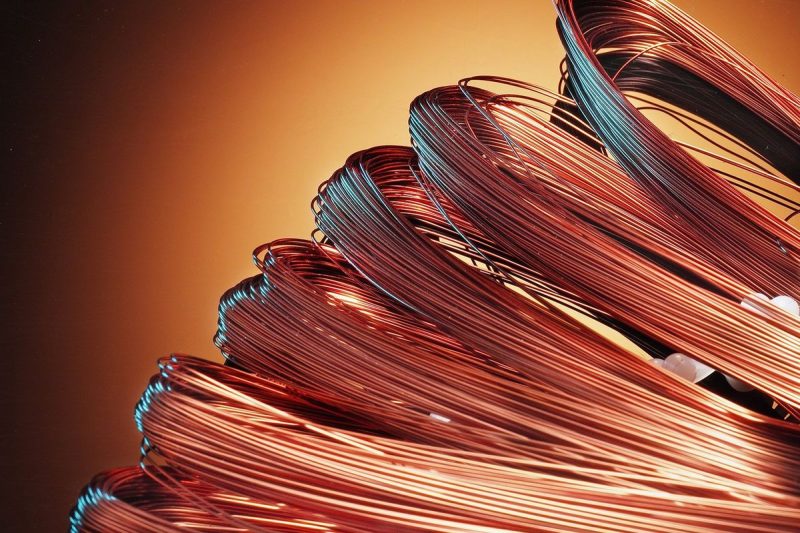

Copper, often referred to as Dr. Copper due to its significant role as a bellwether for the global economy, is a critical industrial metal used in a wide range of applications. Investors looking to gain exposure to copper can consider Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs) that track the performance of copper prices. Here are the top 6 copper ETFs and ETNs to watch in 2024:

1. **United States Copper Index Fund (CPER):** This ETF seeks to track the performance of the SummerHaven Copper Index Total Return, providing exposure to copper futures contracts. CPER has been a popular choice for investors looking for direct exposure to copper prices.

2. **iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC):** JJC is an ETN that offers exposure to the Bloomberg Copper Subindex Total Return, which reflects changes in the price of copper futures contracts. It provides a convenient way for investors to access the copper market.

3. **Global X Copper Miners ETF (COPX):** Instead of tracking copper prices directly, COPX offers exposure to copper mining companies. Investing in COPX allows investors to benefit from the performance of companies engaged in copper mining activities.

4. **First Trust Indxx Global Natural Resources Income ETF (FTRI):** FTRI is a unique ETF that invests in global companies involved in the exploration, development, and production of natural resources, including copper. It provides a diversified approach to investing in the natural resources sector.

5. **Breakwave Dry Bulk Shipping ETF (BDRY):** While not a direct copper play, BDRY offers exposure to the shipping industry, which plays a crucial role in transporting commodities like copper. Investors bullish on copper prices may find BDRY appealing due to its indirect exposure to the commodity.

6. **United States 12 Month Copper Index Fund (CPER):** Another offering from United States Commodity Funds, CPER aims to reflect the performance of the SummerHaven Copper Index 12 Month Forward Total Return. This ETF provides exposure to copper through a diversified set of futures contracts with varying expiration dates.

In conclusion, investing in copper through ETFs and ETNs offers investors a convenient way to gain exposure to this important industrial metal. Whether you prefer direct exposure to copper prices or want to invest in copper-related industries, there are several options available in the market. Before investing, it is essential to conduct thorough research and consider your investment goals and risk tolerance.

—

Feel free to let me know if you need more information or further assistance!