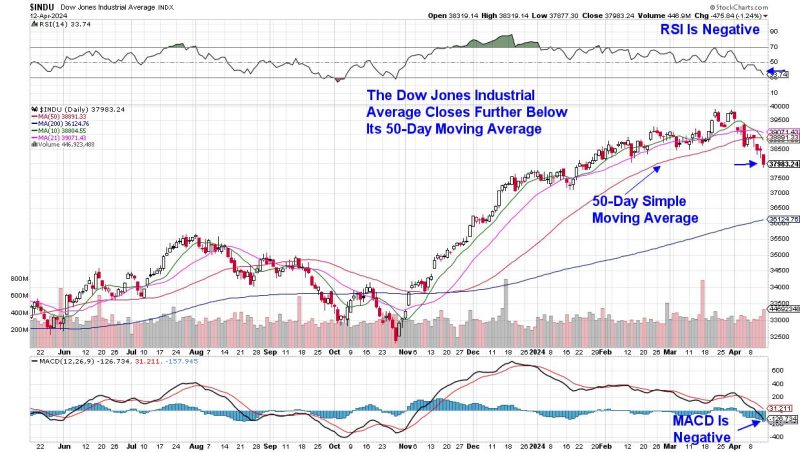

In recent weeks, investors have been closely monitoring the performance of the Jones Industrial Average, particularly following the release of a report indicating weaknesses in the index. Market analysts have highlighted the significance of the Jones Industrial Average as a key indicator of broader market health and potential corrections. Understanding the implications of these weaknesses is crucial for investors looking to navigate the current economic landscape and make informed decisions.

One of the primary reasons for the concern surrounding the weaknesses in the Jones Industrial Average is its historical track record as a reliable barometer for the overall market performance. The index, which comprises 30 blue-chip stocks representing a diverse range of industries, is often seen as a reflection of the broader economic conditions and investor sentiment. Therefore, any signs of weakness in the index can serve as an early warning signal for potential market corrections.

Furthermore, the composition of the Jones Industrial Average plays a crucial role in shaping its impact on the market. The inclusion of large multinational corporations with significant market capitalization means that movements in the index can have a ripple effect across various sectors and industries. As such, weaknesses in the index can signal underlying issues at the core of the economy, prompting investors to reevaluate their portfolios and risk exposure.

Moreover, the recent analysis pointing to weaknesses in the Jones Industrial Average highlights the importance of proactive risk management strategies for investors. By closely monitoring key market indicators such as the index, investors can stay ahead of potential market shifts and adjust their investment strategies accordingly. Diversification, hedging, and asset allocation are some of the key techniques investors can leverage to mitigate risks associated with market corrections.

Another crucial aspect to consider in light of the weaknesses in the Jones Industrial Average is the broader macroeconomic environment. Factors such as inflation, interest rates, and geopolitical tensions can all impact market performance and influence investor behavior. Therefore, staying informed about these macroeconomic indicators and understanding their interplay with the index is essential for making well-informed investment decisions.

In conclusion, the weaknesses in the Jones Industrial Average serve as a critical indicator for potential market corrections and underline the need for investors to adopt a proactive approach to risk management. By staying vigilant, diversifying portfolios, and understanding the broader economic landscape, investors can position themselves to weather potential market turbulence and capitalize on investment opportunities. The Jones Industrial Average may be just one piece of the puzzle, but its movements can provide valuable insights for investors navigating the dynamic world of finance.