RRG Indicates That Non-Mega Cap Technology Stocks Are Improving

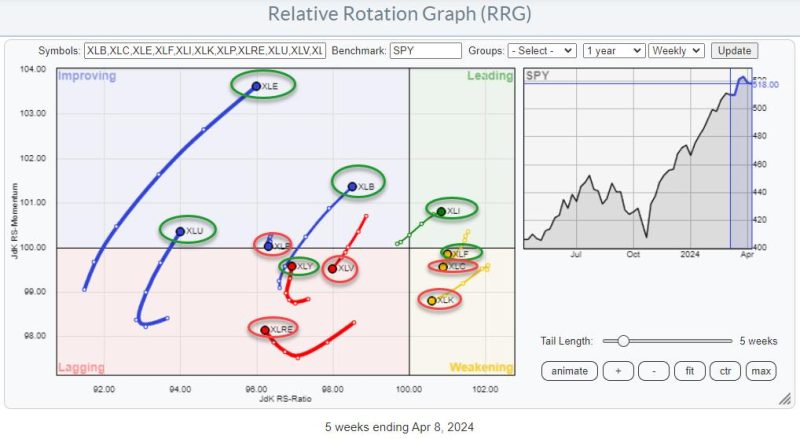

The Relative Rotation Graph (RRG) has long been a tool used by investors to gain insights into the market and potential trends. This powerful tool can help identify sectors or stocks that are gaining strength or losing momentum relative to the market benchmark. In recent times, the RRG has indicated an interesting shift in the technology sector, particularly among non-mega cap stocks.

One key observation from the RRG is that non-mega cap technology stocks are showing signs of improvement. This implies that stocks outside the largest technology companies are starting to outperform the broader market and gaining positive momentum. This shift is significant as it suggests a broader participation in the tech sector beyond the giants like Apple, Amazon, Google, and Facebook.

Historically, mega-cap stocks have dominated the technology sector, attracting a significant portion of investor attention and capital. However, the recent RRG data suggests that investors are now increasingly looking beyond these big names and exploring opportunities in smaller and mid-sized technology companies. This diversification within the tech sector could lead to a more balanced market and potentially drive further growth in the coming months.

Another important aspect highlighted by the RRG is the potential for non-mega cap technology stocks to provide better returns compared to their larger counterparts. As investors seek higher growth prospects and more attractive valuations, smaller tech companies may offer compelling investment opportunities. Moreover, these companies often have greater room for innovation and agility, allowing them to capitalize on emerging trends and disruptive technologies.

The improving performance of non-mega cap tech stocks could also indicate a shift in investor sentiment towards riskier assets. As market participants become more confident in the economic recovery and global growth prospects, they may be more willing to bet on smaller companies with higher growth potential. This shift in risk appetite further underscores the changing dynamics within the technology sector and the broader market.

It is important for investors to monitor the RRG and other technical indicators closely to identify opportunities and risks in the market. The RRG provides valuable insights into sector rotations and stock movements, helping investors make informed decisions and adjust their portfolios accordingly. By keeping a close eye on the RRG and understanding its implications, investors can stay ahead of the curve and capitalize on emerging trends in the market.

In conclusion, the recent data from the RRG suggests that non-mega cap technology stocks are on the rise, signaling a potential shift in market dynamics and investor preferences. As smaller tech companies gain momentum and outperform their larger counterparts, investors have the opportunity to diversify their portfolios and explore new growth avenues. By leveraging tools like the RRG, investors can navigate the changing market landscape with confidence and position themselves for success in the evolving tech sector.