Market Research and Analysis: Understanding the Value of Technical Analysis

The world of finance and trading is a complex and dynamic environment where individuals and institutions seek to make informed decisions that will lead to profitable outcomes. In this pursuit, market research and analysis play a crucial role in providing the necessary insights to navigate the ever-changing landscape of the global financial markets. One key approach to analyzing market trends and patterns is through technical analysis.

Technical analysis is a method used by traders and investors to evaluate and forecast the future direction of asset prices based on historical market data and statistics. This approach involves studying past market behavior, such as price movements and trading volume, to identify patterns and trends that can help predict future price movements. By using charts and other technical tools, analysts can gain valuable insights into potential market opportunities and risks.

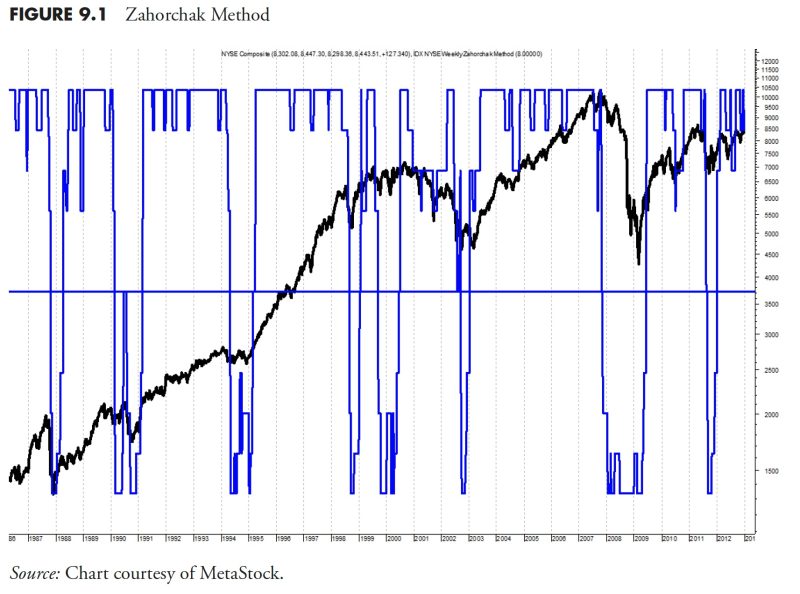

One of the primary reasons why technical analysis is valued in the financial industry is its ability to provide a visual representation of market data. Charts and graphs offer an intuitive way to interpret complex market information and identify patterns that may not be apparent from raw data alone. Visualizing price movements over time can help traders spot trends, support levels, and resistance levels, which are essential for making informed trading decisions.

Another key benefit of technical analysis is its focus on objective data and statistics. Unlike fundamental analysis, which relies on subjective interpretations of economic indicators and company financials, technical analysis is based on empirical evidence and mathematical calculations. This data-driven approach helps reduce the impact of emotions and biases on decision-making, leading to more disciplined and systematic trading strategies.

Moreover, technical analysis is widely used in conjunction with other analytical methods to gain a comprehensive understanding of market dynamics. By combining technical analysis with fundamental analysis, sentiment analysis, and macroeconomic analysis, traders can develop a well-rounded perspective on the market environment and make more informed investment decisions. This multi-faceted approach allows traders to confirm trading signals and minimize the risk of false positives.

In conclusion, technical analysis is a valuable tool for market research and analysis due to its ability to provide visual representations of market data, its reliance on objective data and statistics, and its compatibility with other analytical methods. By leveraging technical analysis, traders and investors can gain valuable insights into market trends and patterns, make informed trading decisions, and improve their overall success in the financial markets.